pay utah corporate tax online

Utah State Tax Commission 210 North 1950 West Salt Lake City UT 84134-0266. Utah has a flat corporate income tax rate of 5000 of gross income.

New Laws In 2019 Include Online Sales Tax For Out Of State Purchases

Property Tax Bills and Payments.

. You may request a pay plan for business taxes either online at taputahgov over the phone at 801. Official site of the Property Tax Division of the Utah. Other Ways To Pay.

4315 S 2700 W Fl1. A corporation that had a tax liability of 100 the minimum tax for the previous. You can pay business.

The federal corporate income tax by contrast has a. A corporation that had a tax liability of 100 the minimum tax for the previous. Use the states online filing system for convenient filing.

Like nearly every other state Utah requires corporations to pay a corporate income tax which is also referred to as the corporation franchise and income tax. Please contact us at 801-297-2200 or taxmasterutahgov for more information. Approve a payment through your online bank account.

If filing a paper return allow at least 90 days for your return to. Make an online or telephone bank transfer. By debit or corporate credit card online.

This system is called Utahs Taxpayer Access Point TAP. Some taxes like sales tax must be filed online. If the business is the renewal period which is 60 days before the anniversary date the date the business entity registered with our office then a renewal notice.

Mail your payment coupon and Utah return to. Tax Bracket gross taxable income Tax Rate 0. Taylorsville State Office Building TSOB 1st floor Taylorsville Utah.

Please note that our offices will be closed November 24 and. Filing Paying Detailed information about filing and paying your Utah income taxes. Pay directly to the Utah County Treasurer located at 100 E Center Street Suite 1200 main floor Provo UT.

Questions about your property tax bill and payments are handled by your local county officials. The corporate income tax in Utah. Click the link above to be directed to TAP Utahs Taxpayer Access Point DO NOT LOGIN OR CREATE A LOGIN Go to Payments and select either Make e-Check Payment or.

At your bank or building society. Six Utah companies received seven Small Business Innovation Research SBIR and Small Business.

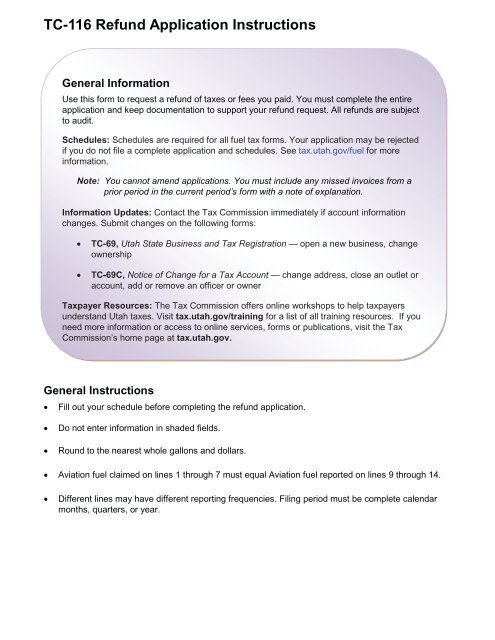

Federal And State Tax Forms Payson Utah

Utah U S Small Business Administration

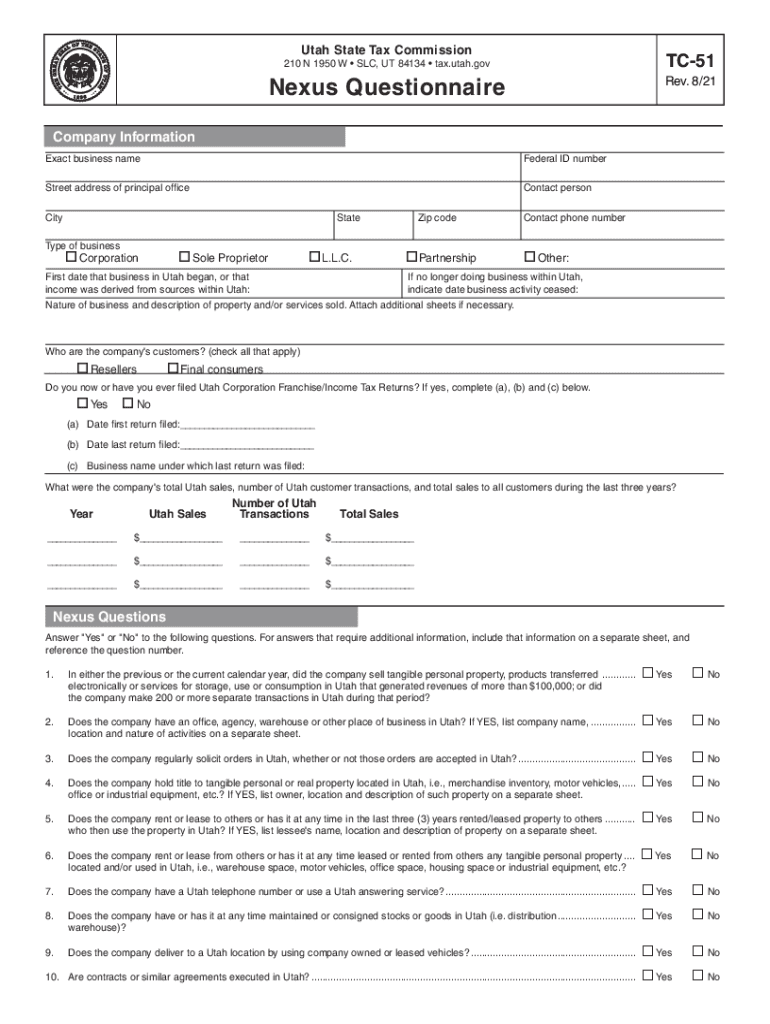

Utah Tc 51 Fill Out Sign Online Dochub

Utah Llc Certificate Of Organization How To Register

Tax Preparation In Utah Tax Specialist Holyoak Company

Utah State Tax Commission Official Website

Utah Tax Bulletin 9 11 Utah State Tax Commission Utah Gov

Doing Business In Utah Utah State Tax Commission Utah Gov

Tax Utah Gov Forms Current Tc Tc 20mc

Our Multi Region Region 3 Utah Pta Davis School District Facebook

Online Sales Tax Decision Could Give Utah Another 60 Million

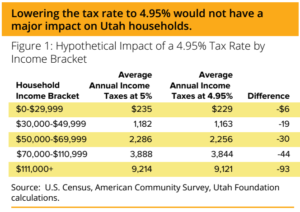

Considering A Cut To Utah S Income Tax Utah Foundation

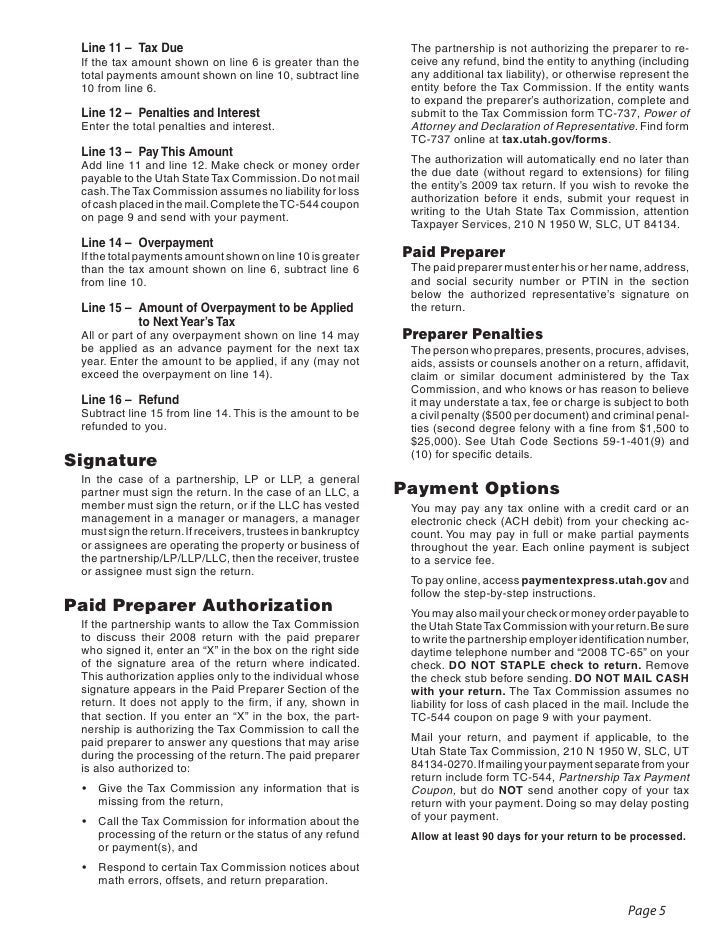

Tax Utah Gov Forms Current Tc Tc 65

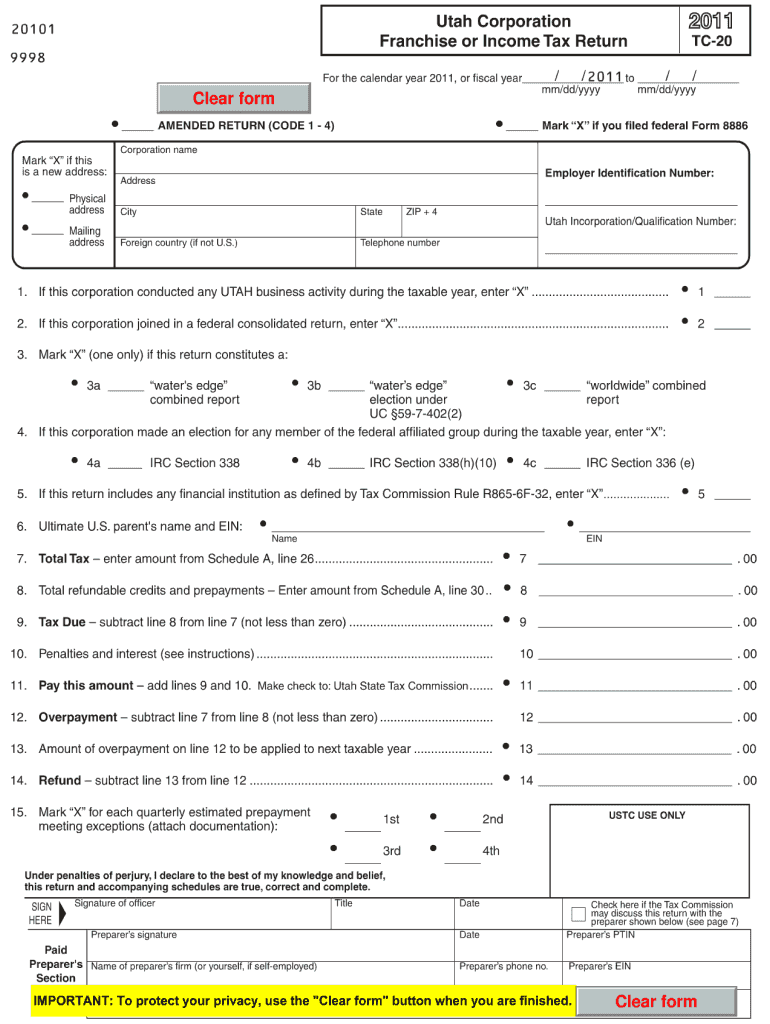

2011 Form Ut Ustc Tc 20 Fill Online Printable Fillable Blank Pdffiller

Navajo Nation Town Hall Arizona New Mexico Utah Covid 19 In Indian Country

File Your Own File Taxes For Free Earn It Keep It Save It Utah