income tax rates 2022 australia

Ad Compare Your 2022 Tax Bracket vs. C for every dollar over 180000.

Ten Reasons Why The Arguments Against Increasing Tax Are Wrong The Australia Institute

26 percent and 28 percent.

. Tax Rates for 2022-2023. Australia Residents Income Tax Tables in australia-income-tax-system. Your 2021 Tax Bracket to See Whats Been Adjusted.

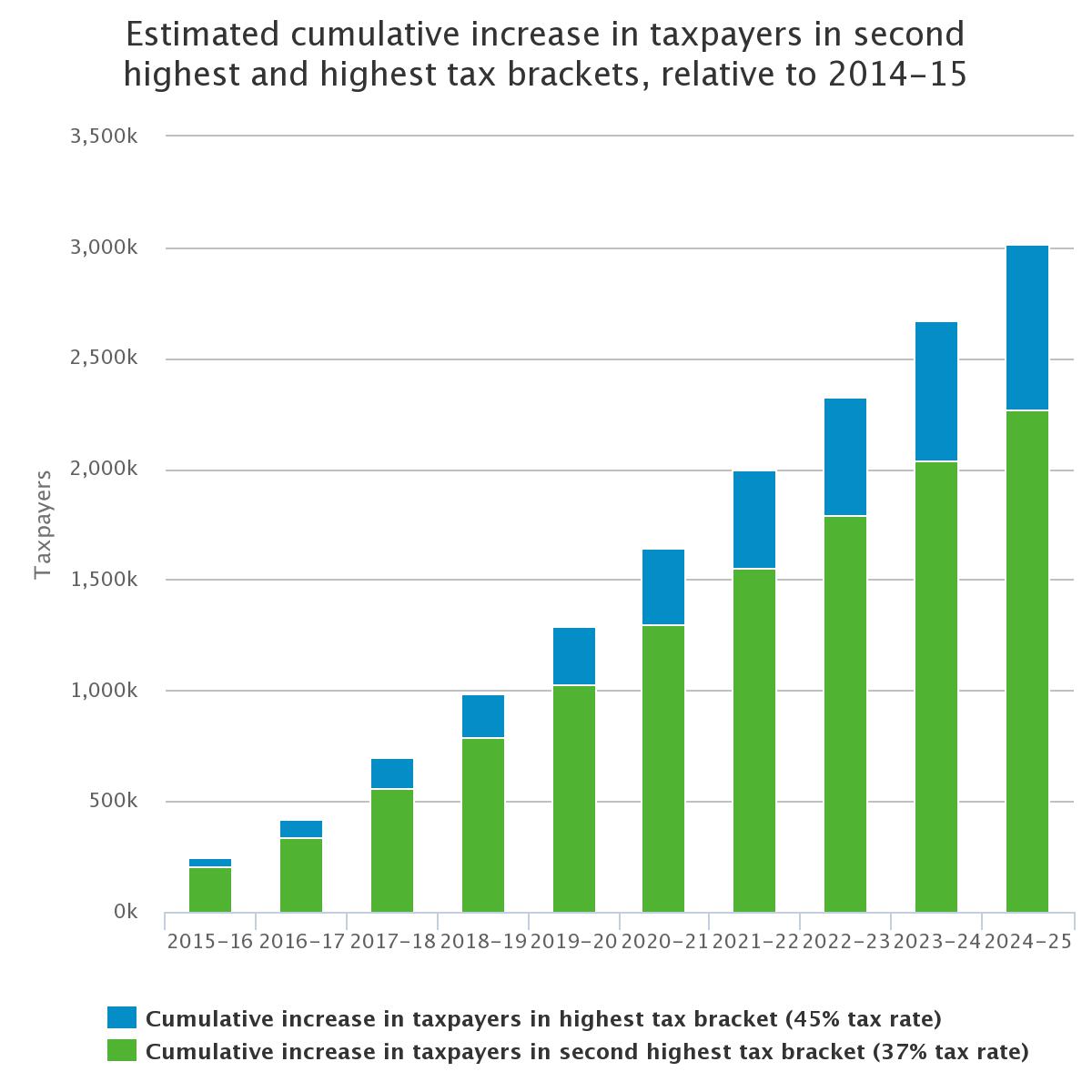

FBTFringe benefits tax FBT rates and thresholds for employers for the 201819 to 202223 FBT years. These include companies corporate unit trusts and public trading trusts. The next phase of the tax cuts will eventually remove the 325 and 37 marginal tax rates which will result in around 94 of Australian taxpayers facing a marginal tax rate of 30 or less in the 202425 and later income years.

A subsequent Budget 2019 measure further expanded the 19 income ceiling to 45000 from 1 July 2022. A base rate entity for an income year is. Australia Personal Income Tax Rate - 2021 Data - 2022 Forecast - 2003-2020 Historical Australia Personal Income Tax Rate The Personal Income Tax Rate in Australia stands at 45 percent.

2022 Tax Rates Thresholds and Allowance for Individuals Companies Trusts and Small Business Corporations SBC in Australia. The AMT is levied at two rates. Tax Rates for 2021-2022.

19 for amounts over. Income tax rate and will provide a minimum net tax benefit of 85 with a premium tier of 165 for an RD spend with an intensity exceeding 2. Median household income australia 2022.

Low income tax offset in 2022. If your company is a base rate entity your company tax rate is 25 from the 202122 income year onwards. Personal Income Tax Rate in Australia remained unchanged at 45 in 2021.

An FBT rate of 47 applies across these years. In 2022 the 28 percent AMT rate applies to excess AMTI of 206100 for all taxpayers 103050 for married couples filing separate returns. 19c for each 1 over 18200.

If you are looking for an alternative tax year please select one below. What is personal tax rate in Australia. 19 for amounts over 18200.

Reflected in the above table are tax rate changes from the 2018 Budget for the 2 years from 1. The maximum rate was 47 and minimum was 45. Australia Income Tax Rates for 2022 Australia Income Tax Brackets Australia has a bracketed income tax system with five income tax brackets ranging from a low of 000 for those earning under 6000 to a high of 4500 for those earning more then 180000 a year.

Also as part of the 3-step plan the Government has increased the existing Low Income Tax Offset LITO from AUD 455 to AUD 700. 6 rows Tax Rates 2021-2022 Year Residents Tax Scale For Year Ended 30 June 2022 Taxable IncomeTax. Australia has a bracketed income tax system with five income tax brackets ranging from a low of 000 for those earning under 6000 to a high of 4500.

Income thresholds Rate Tax payable on this income. Base rate entity company tax rates The company tax rate for base rate entities has fallen from 275 to 26 in 20202021 financial year and is now down to 25 for 20212022 and later income years. The Monthly Wage Calculator is updated with the latest income tax rates in Malaysia for 2022 and is a great calculator for working out your income tax and salary after tax based on a Monthly income.

19c for every dollar between 18201 - 0. 19c for each 1 over 18200. No tax on income between 1 - 18200.

Discover Helpful Information and Resources on Taxes From AARP. Median household income australia 2022 05142022. Data published Yearly by Taxation Office.

Australian Taxation Office 10Y 25Y 50Y MAX Chart Compare Export API Embed Australia Personal Income Tax Rate. Fringe benefits tax - historical rates and thresholdsHistorical fringe benefits tax FBT rates and thresholds for the 201314 to 201718 FBT years. Two further incentive regimes are proposed to start as from 1 July 2022.

For your company to be a base rate entity it needs to meet the. Taxable income Tax rate Taxable income Tax rate Taxable income Tax rate Taxable income Tax rate. 37c for every dollar between - 180000.

In July 2034 your income will fall below the minimum threshold Final payment date. 5 rows Low and Middle Income Tax Offset LMITO income tax rates and thresholds for 2022. Individual income tax rates.

19 for amounts over 18200. 325c for every dollar between - 0. The LITO will be recovered at a rate of 5 cents per dollar between taxable incomes of AUD 37500 and AUD 45000 and an additional 15 cents per dollar from taxable incomes between AUD 45001 and AUD 66667.

51667 plus 45c for each 1 over 180000 A subsequent budget 2019 measure further expanded the 19 income ceiling to 45000 from 1 july 2022. Did you know that reduced tax rates may be available to eligible entities. How does the Australia Income Tax compare to the rest of the world.

The AMT exemption amount for 2022 is 75900 for singles and 118100 for married couples filing jointly Table 3. 19 for amounts over 18200. A patent box regime for medical and.

Australia Personal Income Tax Rate was 45 in 2022. Tax on this income. You are viewing the income tax rates thresholds and allowances for the 2022 Tax Year in Australia.

In July 2034 your. 12 May 2022.

Australia Macquaire Proof Of Address Bank Statement Template In Word And Pdf Format Doc And Pdf Datempl Tem In 2022 Statement Template Bank Statement Templates

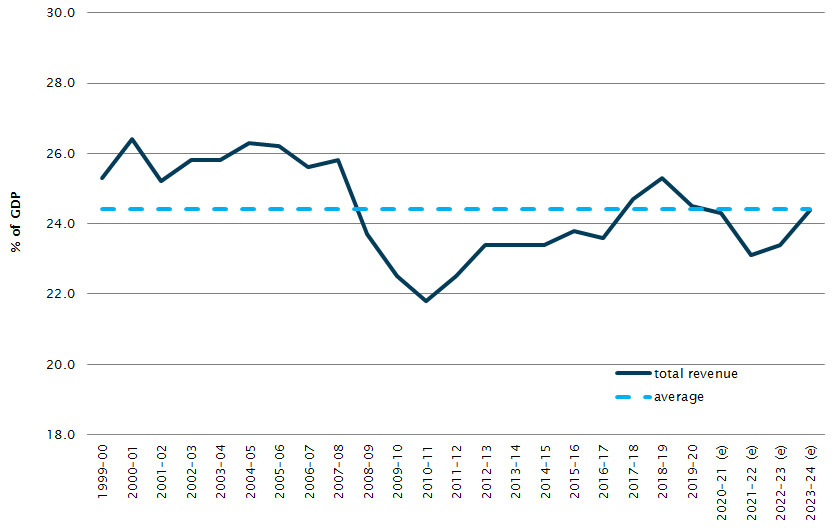

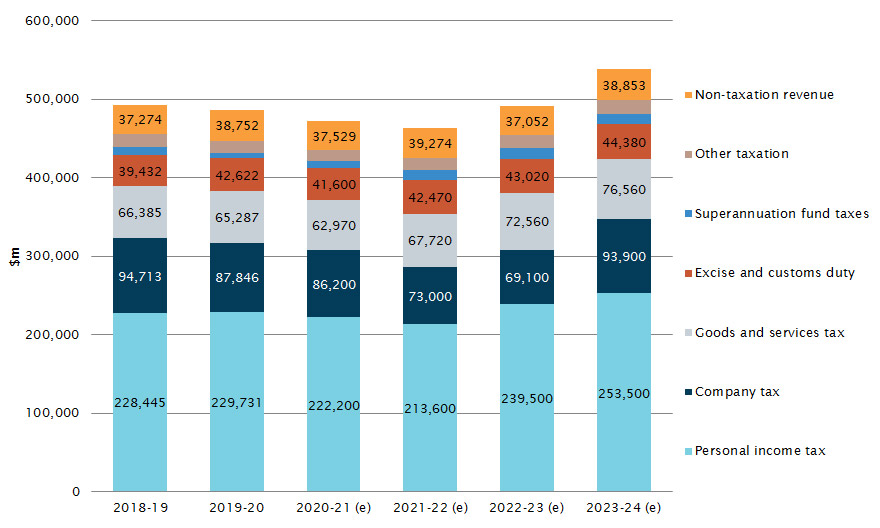

Australian Government Revenue Parliament Of Australia

Australia Medicare Card Template In Psd Format Fully Editable Gotempl Templates With Design Service In 2022 Medicare Templates Document Templates

Online Tax Return Australia Lodge Tax Return Tax Refund Irs Taxes Tax Season

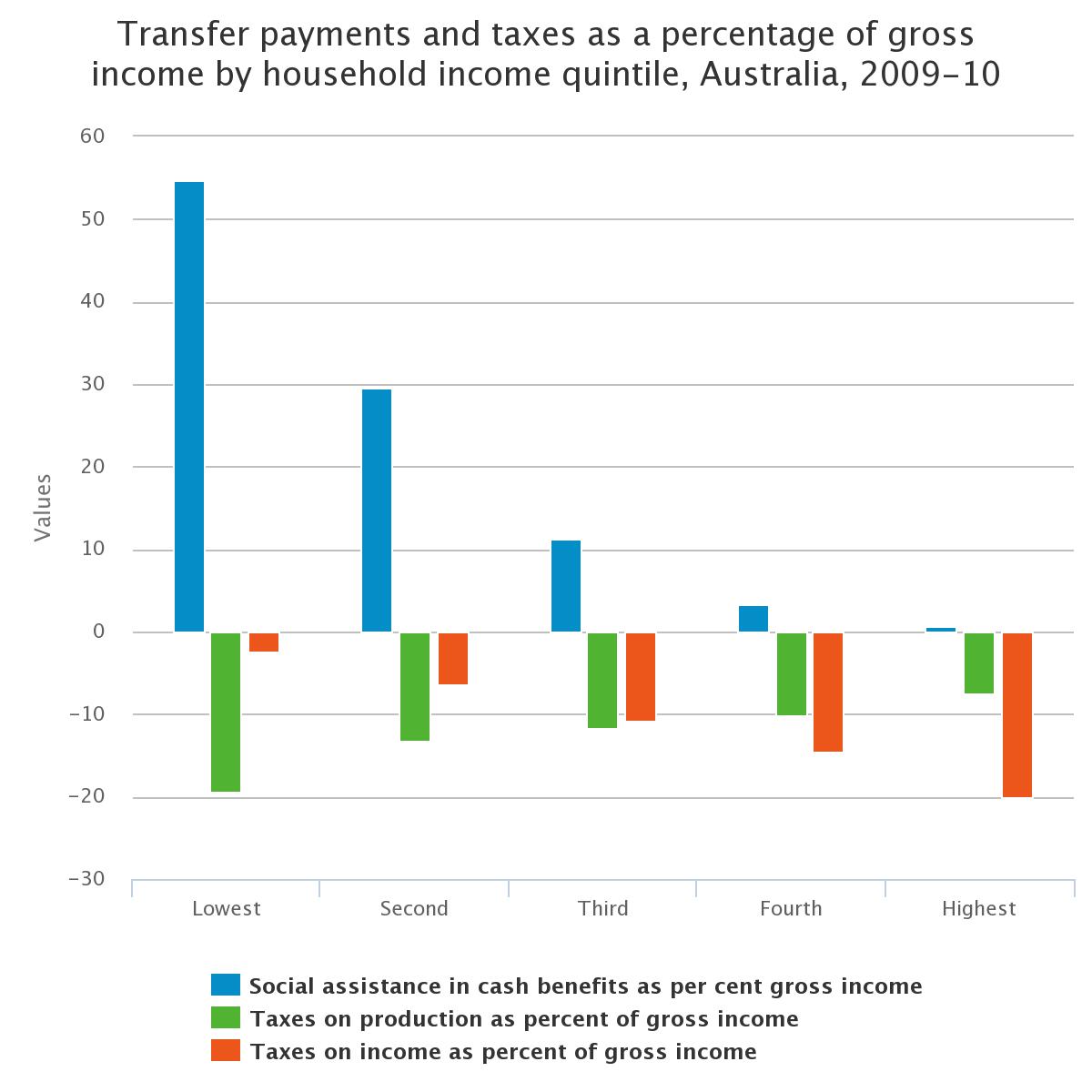

Ten Reasons Why The Arguments Against Increasing Tax Are Wrong The Australia Institute

Australian Government Revenue Parliament Of Australia

Australian Government Revenue Parliament Of Australia

The Presentation Explains Tax Aspects Of Accounting In Australia Computation Of Taxable Inf Accounting Services Small Business Accounting Bookkeeping Services

Stage 3 Tax Cuts Go To Wealthy Occupations Low Middle Income Earners Miss Out Report The Australia Institute

Australian Government Revenue Parliament Of Australia

60 000 After Tax Au Breakdown May 2022 Incomeaftertax Com

Ten Reasons Why The Arguments Against Increasing Tax Are Wrong The Australia Institute

Australian Income Tax Brackets And Rates For 2021 And 2022

Tax Brackets Australia See The Individual Income Tax Tables Here

Sample Resume Civil Engineer Australia Resume Sample 90 Engineering Resume Resume Template Australia Resume Writing Services